Your Dental Plan Options

Open Enrollment July 30-August 12

No changes to current plans. Enrollment is only needed if you're new or want to make a change.

Your Dental Plan Options

Open Enrollment July 30-August 12

No changes to current plans. Enrollment is only needed if you're new or want to make a change.

Ready to schedule your enrollment meeting? Virtual or In-person appointments now available.

Meet with American Fidelity for help enrolling in your benefits. Meetings are free and only takes a few minutes.

Alpine Dental Plans

- TDA Peak Care Plus Plan Summary* (see note below)

- TDA Peak Care Plus Copay Schedule*

- Premier 100 (D3) Plan Summary

- Premier 100 (D3) Fee Schedule

- Advantage Copay (D2) Plan Summary

- Advantage Copay (D2) Copay Schedule

- TDA Elite Choice Plan Summary

- TDA Elite Choice Copay Schedule

- Choice PPO (D5) Plan Summary

- TDA MAC Plan Summary

- TDA Companion Plan Summary

- Premium Costs - Rates for each plan side-by-side

- Comparison Chart

Alpine Uniserv Dental Plans

*Important Note for Peak Care Plus (DHMO) Plan Members

If you choose the Peak Care Plus (DHMO) dental plan, you’ll need to select a primary dental provider when you enroll.

There are two easy ways to do this:

During enrollment: Your American Fidelity representative can help you choose and submit your provider

After enrollment: Call our EMI Health Alpine Customer Support Line at (800) 650-0401, Monday–Friday, 6:00 AM to 6:00 PM

Need step-by-step help?

Click here to view the DHMO Provider Selection Flyer

Make sure you’ve selected a provider to avoid delays in using your benefits.

Understanding EMI Health Dental Plan Types

EMI Health offers a variety of dental plans to meet different needs and preferences. The categories below provide a general overview of typical coverage features for each type of plan. While these descriptions offer helpful guidance, they may not reflect every detail.

Please refer to the official plan summaries for exact coverage levels, benefits, and limitations.

DHMO Plans

- Peak Care Plus

Lowest cost, but most restrictions.

DHMO plans require members to choose a primary dentist from the network. That dentist manages all care and referrals. Services are either free or have low copays.

Best for: Employees looking for the most affordable dental option and willing to stay in-network.

-

No deductible or annual maximum

No deductible or annual maximum

-

Must see your assigned dentist

Must see your assigned dentist

-

No coverage for out-of-network care

No coverage for out-of-network care

Copay Plans

- Advantage Copay (D2)

- Elite Choice

Predictable costs, limited network.

Copay plans list set dollar amounts for each dental service. You know upfront what you’ll pay.

Best for: Employees who want budget certainty.

-

Fixed fees for each procedure

Fixed fees for each procedure

-

Often no deductible or coinsurance

Often no deductible or coinsurance

PPO Plans

- Choice PPO (D5)

- Premier (100) (D3)

- TDA Companion

- TDA PPO MAC

Go to any dentist, but save more in-network.

PPO plans let you see any licensed dentist, but you’ll save more with in-network providers. They usually cover preventive care at 100% and partially cover basic and major services.

Best for: Employees who want flexibility and are willing to pay more for it.

-

Freedom to see out-of-network providers

Freedom to see out-of-network providers

-

No referrals needed for specialists

No referrals needed for specialists

-

Often includes a deductible and coinsurance

Often includes a deductible and coinsurance

Please note: Plan features and coverage levels may vary based on your employer’s specific dental plan. Be sure to review your official plan summary for the exact benefits, costs, and provider details that apply to you.

| Plan-in order of lowest to highest premium | Premium-Single | Network Name | Network Size | Orthodontic? | Best For: |

| TDA Peak Care Plus | $15.17 | DHMO-UT | No | Low cost, no annual max, predictable costs | |

| Premier 100 (D3) | $19.17 | Premier | No | Preventive care only | |

| Advantage Copay (D2) | $26.90 | Advantage | No | Low cost, strong benefits, includes pediatric | |

| TDA Elite Choice | $33.21 | TDA PPO | No | Predictable costs, including specialists, high annual maximums | |

| Choice PPO (D5) | $38.50 | Advantage Plus+Premier | No | Specialists covered, out-of-network, has deductibles & annual maximums | |

| TDA MAC | $41.62 | TDA PPO | Yes | Specialists covered, out-of-network, has deductibles & annual maximums | |

| TDA Companion | $45.97 | TDA PPO | Yes | Specialists covered, best out-of-network, has deductibles & annual maximums |

Please note: This chart highlights a few key differences between plans to help you compare at a glance. It does not include all features, limitations, or considerations. For a complete list of benefits, exclusions, and details, please refer to the official plan summary for each option.

-

Preventive Care

-

Basic Services

-

Major Services

-

Orthodontics

![]() Includes treatments like fillings and simple extractions. These services are often shared between you and the plan, depending on your specific benefits.

Includes treatments like fillings and simple extractions. These services are often shared between you and the plan, depending on your specific benefits.

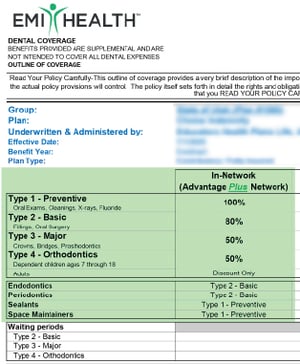

Where to Find Your Coverage Details

Every dental plan is a little different. To see exactly what your plan covers for each type of care—check the plan benefits summary in your enrollment booklet OR your plan documents in your My EMI Health account online dashboard, if you are a member.

A Few Important Things to Know

The amount your plan pays depends on the type of care and your specific dental plan. Each category—preventive, basic, major, and orthodontic—may be covered at different levels.

To find out exactly how your plan pays for care, refer to the plan summary in the back of your enrollment booklet.

Deductible

Waiting Periods

A waiting period is the amount of time you must be enrolled in your dental plan before certain types of care are covered. While preventive services like cleanings and exams are usually covered immediately, other services may have a delay.

Annual Maximum

The total amount the plan will pay for dental care each year. This maximum is usually listed as per person and per family. Once you reach this amount, you’ll pay any additional costs out-of-pocket.

Do you want to keep your current dentist?

Use our Provider Search Page to check before you choose a plan. Staying in-network saves you money.

Some plans only cover in-network providers, while others allow out-of-network coverage at a reduced rate.

Look for:

• "In-Network vs Out-of-Network" section (often near the top chart)

• "Network / Reimbursement Schedule"

• Terms like MAC, R&C, or No Coverage

Tip:

If your dentist is not in the network, look for plans that reimburse using MAC (Maximum Allowable Charge) or R&C (Reasonable & Customary)—these allow some out-of-network flexibility.

Are you covering a spouse or kids?

Look for:

- "Dependent Coverage" in the orthodontics or preventive sections

- Age limits listed under fluoride, sealants, or orthodontics

- “Type 4 – Orthodontics” section

Tip:

Most plans cover sealants and fluoride only up to age 16, and orthodontics for children 7–18.

Will you or your family need braces?

Orthodontic coverage isn’t always included—and often has strict limits.

Look for:

• "Type 4 – Orthodontics"

• “Discount Only,” “No Coverage,” or specific coinsurance (%)

Tip:

Some plans cover orthodontics for children only, and only in-network. Adult orthodontics is often listed as “Discount Only” or not covered.

Do you expect major dental work (like crowns or dentures)?

These fall under Type 3 – Major services and can be expensive.

Look for:

• "Type 3 – Major" coverage percentages

• Frequency limitations (e.g., “1 every 5 years per tooth”)

• Implant and anesthesia coverage

Tip:

Major services are usually covered at 40%–50% in PPOs, but copay plans often use fixed fees listed in a separate schedule.

Do you want predictable, fixed costs for each dental visit?

Copay or DHMO plans offer set fees instead of percentages.

Look for:

• “See Co-Pay Schedule” or “Fee Schedule” under most categories

• No coinsurance percentages

• In-network only benefits

Tip:

If it says “See Co-Pay Schedule” in most sections and shows $0 deductibles, it’s a copay-style plan. These are good if you prefer cost certainty.

Are you only planning on getting cleanings and exams?

All plans include preventive care, but the cost and network rules may vary.

Look for:

• "Type 1 – Preventive"

• Coverage level (typically 100%)

• “In-Network” column vs “Out-of-Network” coverage

Tip:

Preventive services are almost always free in-network, but out-of-network coverage may be limited or not covered at all on some plans.

Are you okay with paying a little more each month for more provider flexibility?

Plans with wider provider access usually come with higher premiums.

Look for:

• Monthly rates (Employee / Two-Party / Family)

• Out-of-Network reimbursement details

• “MAC” or “R&C” language

Tip:

Compare premiums shown at the bottom of the summary with flexibility offered in the coverage chart. PPO plans often cost more but let you see more dentists.

DHMO UT Network (Peak Care Plus Plan)

Member must choose a dentist from provider list and all care must be coordinated by them.Narrow network

TDA PPO Network (Elite Choice, TDA PPO MAC, TDA Companion Plans)

Large network, includes pediatric providers2,700+ providers in Utah

Advantage Network (Advantage Copay Plan)

Large network3,100+ Providers in state

Advantage Plus & Premier Networks (Choice PPO)

Largest network, includes specialists3,900+ Providers in state

Premier Network (Premier 100)

Largest network, includes specialists.3,900+ dentists in Utah

Search for a Dental Provider

You can search for in-network doctors, clinics, and specialists at any time, even if you have not enrolled yet. Use the provider search tool as a guest to explore networks, or sign in as a member to see results based on your plan.

For Guests (before enrollment):

- Go to https://emihealth.com/ProviderSearch

- Choose Search as a Guest.

- Click the Dental tab.

- Enter your network, state, and zip code.

- Search for your provider.

How to identify the network from your plan summary:

The Provider Network is found under the Network/Reimbursement Schedule for each plan summary located just above the Monthly Rates section.

Provider Network

Your network name tells you which dental providers are considered in-network. Choosing in-network providers helps you get the most from your benefits and avoid higher out-of-pocket costs.

Alpine Uniserv/AEA

Enrollment and information for all Alpine School District dental plans.

Ready to schedule your enrollment meeting?

Appointments are free, personalized, and take just a few minutes.

Alpine Employee Gateway

Your District HR website for all benefit information.

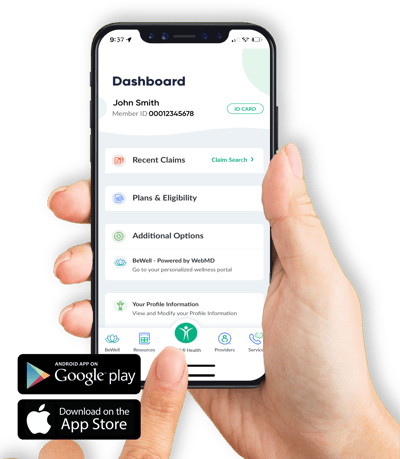

Your Benefits, Right at Your Fingertips.

With our mobile app, you can view your digital ID card, check claims, find in-network providers, and track your benefits on the go. It’s the easiest way to stay connected to your coverage.

Key features include:

- Digital ID cards for you and your dependents

- Real-time claim status and benefit details

- Quick access to provider search

- Secure, simple login

Download the app now: Apple/App Store | Android Google Play

.jpg?width=400&height=459&name=customer_service_AdobeStock_219286958%20(1).jpg)

Customer Service

Whether you’re looking for help with benefits, claims, ID cards, or something else—we’ve got a knowledgeable, friendly team ready to assist.

We’re committed to making your experience as smooth as possible. If something doesn’t make sense, just ask—we’ll walk you through it.